Financial Tips

Personal Finance Tips for Pakistan

(Budgeting, Saving, and Investing)

Overseeing individual budgets is vital for accomplishing monetary dependability and accomplishing long haul objectives. With regards to Pakistan, where monetary circumstances and social variables might impact monetary choices, here are a few reasonable tips on planning, setting aside cash, and money management:

Budgeting:

1.Understand Your Income and Expenses:

List all kinds of revenue, including pay, business pay, or any extra income.

Report month-to-month expenses, including utilities, lease or home loan, food, transportation, and diversion.

2.Make a reasonable financial plan:

Designate a particular piece of your pay to fundamental costs, reserve funds, and optional spending.

Be sensible about your way of life and ways of managing money to make a practical spending plan.

3.Backup stash:

Focus on building a backup stash identical to 3-6 months of everyday costs.

This asset goes about as a monetary security net for unforeseen occasions like health-related crises or employment cuts.

4.Track and change:

Consistently track your spending to guarantee it matches up with your financial plan.

Change the financial plan on a case-by-case basis, particularly while confronting changes in pay or costs.

Saving Money:

1.Automate Savings:

Set up programmed moves to an investment account every month. This guarantees consistency in saving.

Think about opening a different record for explicit objectives, like travel or schooling.

2.Cut Pointless Costs:

Distinguish trivial costs and track down ways of scaling back without undermining your way of life.

Arrange charges or think about making additional savvy choices.

3.Shop Brilliant:

Search for limits, use devotion cards, and exploit deals to save money on normal buys.

Think about costs prior to making critical buys and consider purchasing utilised things whenever the situation allows.

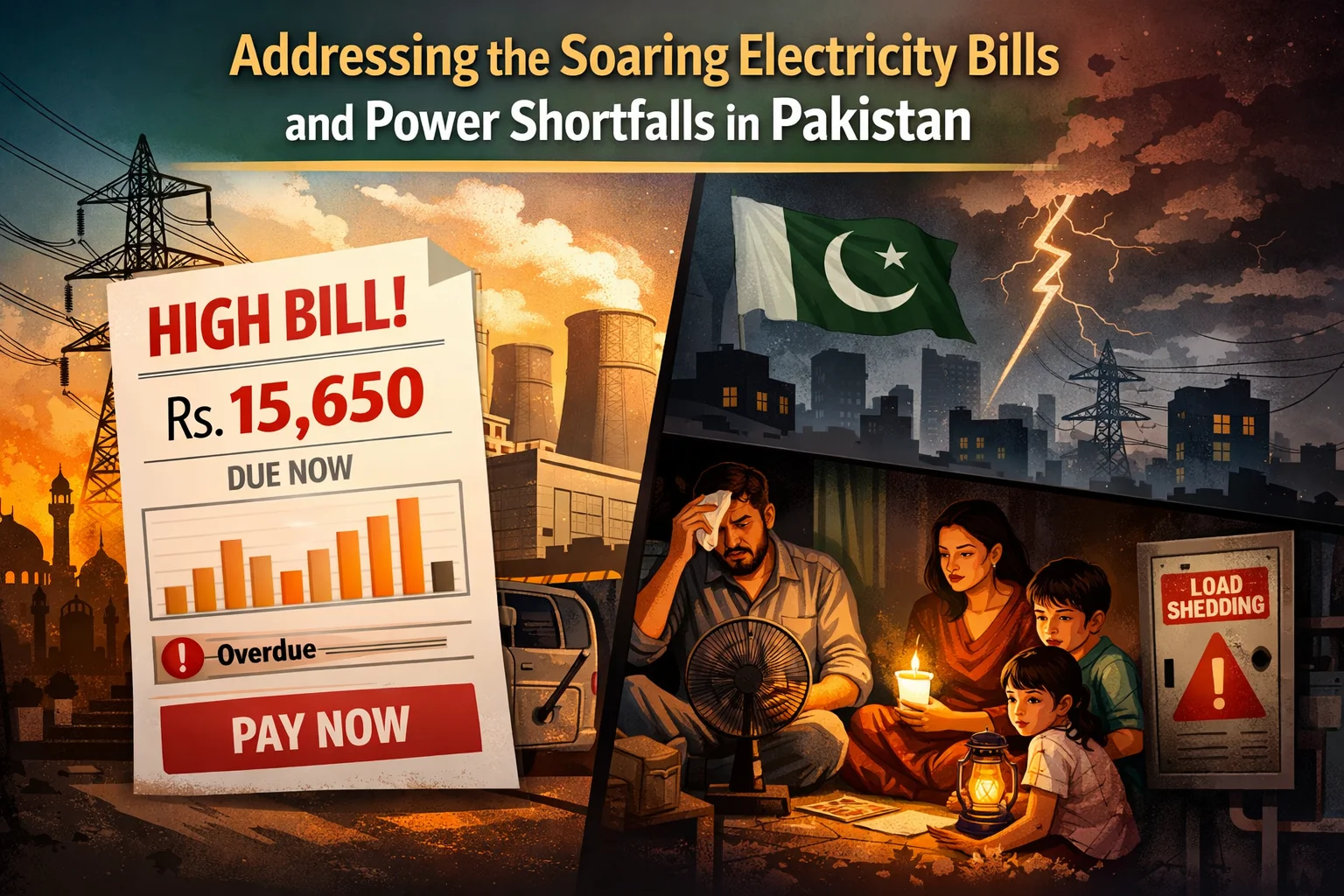

4.Energy Effectiveness:

Save money on service bills by taking on energy-productive practices at home.

Use energy-saving apparatuses and switch out lights and electronic gadgets when not being used.

Investing:

1.Instruct Yourself:

Find out about various speculation choices accessible in Pakistan, including stocks, shared assets, and land.

Remain informed about market patterns and financial pointers.

2.Broaden Ventures:

Broadening helps spread risk. Think about putting resources into a blend of resources, like stocks, bonds, and land.

Talk with a monetary attorney to decide the most reasonable speculation technique for your objectives.

3.Exploit Retirement Plans:

Add to boss-supported retirement plans or open a Willful Benefits Plan (VPS) for charge benefits.

Routinely audit and change your retirement investment fund technique in light of evolving conditions.

4.Put resources into schooling:

Schooling is a significant venture. Consider putting something aside for your own schooling or that of your youngsters through devoted reserve funds plans

.

Financial Challenges Specific to Pakistan:

1.Expansion:

Expansion rates in Pakistan can affect the buying influence of cash over the long haul. Putting resources into resources that outperform expansion is urgent for abundance conservation.

2.Money Vacillations:

Be aware of money gambles, particularly while putting resources into global resources.

Enhance speculations across various monetary standards to moderate the effect of conversion scale changes.

3.Admittance to Formal Banking:

While banking administrations are available in metropolitan regions, country populations might confront difficulties. Investigate portable banking and computerised monetary administration for more extensive access.

4.Loan fee unpredictability:

Loan fees can fluctuate, influencing profits from reserve funds and ventures. Remain informed about money-related approaches and change your monetary procedure likewise.

5.Social Contemplations:

Family and cultural assumptions might impact monetary choices. Offsetting social standards with individual monetary objectives is fundamental.

Keep in mind, an individual budget is a unique cycle that requires customary surveying and change. Talk with monetary specialists, remain informed about monetary circumstances, and design your monetary methodology for your novel conditions and objectives.

You May Like This Post

Sponsored Ad

Post Comment